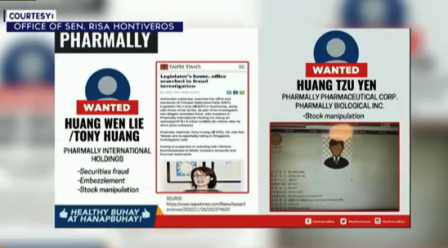

Tax liability ng kumpanyang Pharmally, uungkatin ng Senado

Uungkatin na rin ng Senado sa pagpapatuloy ng imbestigasyon bukas ang posibleng Tax liability ng kumpanyang pinagbilhan ng medical supplies ng gobyerno na Pharmally.

Sinabi ni Senate President Franklin Drilon na kailangang tingnan ang tax records ng kumpanya matapos madiskubre ang red flag sa kanilang financial statement.

Ang Pharmally ang nakakuha ng 10 billion na halaga ng kontrata sa naturang kumpanya.

Sabi ni Drilon batay sa Bayanihan 1 at 2, hindi exempted sa value added tax ang anumang local purchase kaya dapat nagbayad ng witholding tax at vat ang kumpanya.

Batay aniya sa records, ang Pharmally ay isang domestic corporation kaya sakop ito ng probisyon ng Section 27 ng Tax Code.

Senador Drilon:

“Apart from the issue of overpricing, there could be violations of our tax laws by pharmally. we should examine the potential tax liabilities of this dubious trading firm. did pharmally pay any percentage tax? did it pay any excise tax and documentary stamp tax payments? The BIR should review possible violations of the tax laws committed by this dubious and shadowy company that bagged billions of pesos in government contracts. they should zero in on potential tax crimes and tax fraud by pharmally”.

Pinadadalo naman ni Senador Christopher Bong Go ang mga opisyal ng Pharmally at tatlong dating opisyal ng Procurement Service ng Department of Budget and Management.

Ayon kay Go, kailangan nilang magpaliwanag sa Senado kung talagang wala silang itinatago.

Pero sana aniya ay bigyan ng sapat na pagkakataon ng Senate Blue Ribbon Committee ang mga idinadawit na opisyal kabilang na ang negosyate at naging consultant ng Pangulo na si Michael Yang, dating DBM Usec Lloyd Christopher Lao, Anderson Lo at Deputy overall ombudsman Rex Warren Liong.

Inamin ni Go na matagal nang kakilala ni Pangulong Duterte si Yang pero hindi kukunsintihin kapag may nagawang katiwalian.

Meanne Corvera